Issue 97 – April 2019

ALL WOMEN RIDESHARE SERVICE RAISES $3 MILLION!

With $3 million raised from 2,125 investors, (average $1,411 per investor) Shebah, Australia’s first all women rideshare service, have closed their first ever capital raise through Crowd Sourced Funding Equity Raising.

Shebah’s highlights:

- 8% growth per month since 2017

- 113,000 app downloads

- Since inception, Shebah has proudly kept women and children safe for over 200,000 trips

- 95% plus female investors

Recent media coverage:

Shebah has achieved incredible coverage since the campaign started in publications and news outlets such as Sydney Morning Herald, the Australian, Nine News, Women’s Agenda, Smart Company, Start-Up Daily, Yahoo! Finance and more.

The maximum target specified in the Crowd Sourced Funding Offer Document was $3 million. The offer closed fully subscribed.

The success of Shebah highlights the power of Crowd Sourced Funding Equity Raising to assist small companies and medium sized enterprises to be able to raise capital. If you would like to have a discussion with us relative to how this new phenomenon of Crowd Sourced Funding Equity Raising could be utilised within your business, please do not hesitate to contact the person in our firm with whom you normally deal.

CROWD SOURCED FUNDING EQUITY RAISING WAS VERY IMPORTANT FOR US!

This was what Ben Kooyman, CEO of Endeavour Brewing Co, said in an interview relative to his company’s success in raising $556,700 from 579 new shareholders; an average of $961 investment per new shareholder.

Prior to the Crowd Sourced Funding Equity Raise the company successfully completed a share allocation worth $695,000 from the company’s original shareholders (3 initial shareholders who are the directors, plus 30 mates who enjoy a beer!) together with employees, suppliers and customers of the company by utilising s708 if the Corporations Act.

Endeavour Brewing Co operates a craft beer manufacturing and retail business in Argyle Street, The Rocks, Sydney.

Ben Kooyman, indicated that the company has adopted a policy of making beer, much like the making of wine, in that recipes get adapted each year based on the products that are available.

The company’s capital raising target was a minimum of $1 million and a maximum of $3 million. The end result of raising $1,251,700 was very satisfactory for the company directors, Kooyman said.

Ben Kooyman indicated that it is very important that company directors and senior managers of small and medium sized companies familiarise themselves with the opportunities that Crowd Sourced Funding Equity Raising and Section 708 capital raising offer.

He said this is a new way of getting capital – it is not dodgy, but it’s not cheap and it’s not an easy way – you have to work hard for it – but the end result makes it very worthwhile.

When asked whether he would recommend it to other small and medium-sized businesses, Ben Kooyman indicated “yes 100% – it’s a new financing opportunity for small and medium-sized businesses”.

Are you interested in finding out more details on Crowd Sourced Funding Equity Raising? If so, please contact us for a discussion.

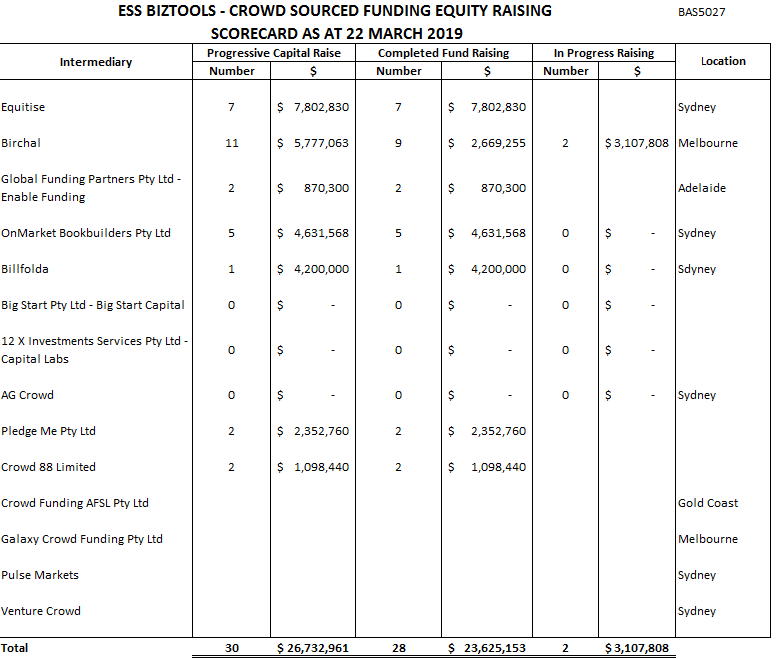

CROWD SOURCED FUNDING EQUITY RAISING SCORECARD

The updated Scorecard for equity raised by Crowd Sourced Funding Equity Raising Companies as at 22nd March 2019 reveals capital raised $26.6 million by 30 companies. Details are as follows:

INTERMEDIARY INTERVIEWS GIVE MORE INSIGHT INTO CROWD SOURCED FUNDING EQUITY RAISING

Thirteen companies have been appointed as Crowd Sourced Funding Equity Raising Intermediaries by the Australian Security Investment Commission (ASIC).

Recently, interviews were conducted with representatives of four of the Intermediary companies so that their views could be collated for the purposes of informing small and medium-sized business operators of what is happening in this very important new financing opportunity for businesses with turnovers under $25 million.

The representatives of the Intermediary companies that participated in these interviews were:

- Alan Crabbe – Co-Founder and CEO, Birchal (Melbourne)

- Matt Pinter – Chairperson, Crowdfunding Institute of Australia (CFIA) and Managing Director of Billfolda (Sydney)

- Arthur Acker - Head of Growth and Operations, Equitise (Sydney)

- Matt Hinds - Managing Director and James Kilby - Co-Founder, AgCrowd (Sydney)

A summary of the comments made by the representatives of these Intermediary companies was as follows:

- Preference for consumer based company – businesses to consumers.

- Companies which can engage with networks - example Shebah - can be very successful.

- Company directors and senior management of small companies and medium-sized enterprises should get familiar with the Crowd Sourced Funding Equity Raising process.

- Company directors and senior managers should talk with people who understand the process and who have been successful in raising capital, but do not ignore the people who were not successful as they might have some interesting tips to give you.

- Important that everyone involved with small and medium-sized businesses are familiar with the regulations.

- Businesses which are potentially scalable to become a global business would normally be successful in raising capital.

- A question was asked do “company directors and senior management from small and medium-sized enterprises know enough about the crowd sourced funding equity raising process” – the answer was “some companies are well informed because they have been watching the space, however more generally a large number of the other companies don’t know about the current rules and, in many cases, didn’t know about the previous restrictions. Some people have read about or heard about Crowd Sourced Funding Equity Raising, but they are not familiar with the changes or the opportunities that have been available since 19 October 2018.

- 2018 was an exciting time for the industry – some people were a little bit disappointed with the overall volumes of transactions conducted, but since 19 October 2018, which was when the law was changed to enable small proprietary companies to be able to raise capital direct from the public, there has been a lot more interest.

- It was stressed that Crowd Sourced Funding is not an angel investment, even though it is similar but it is definitely different to an IPO (Initial Public Offer).

- Crowd Sourced Funding is giving small companies access to a public market – an opportunity that small/medium-sized companies have not had in the past.

- More and more company directors and senior managers have realised that Crowd Sourced Funding Equity Raising is one of the channels for future funding for their companies.

- In the United Kingdom Crowd Sourced Funding represents one third of the venture capital market.

- Progressive consulting businesses/accounting businesses advising small and medium-sized enterprises should be ensuring that their team is familiar with all aspects of Crowd Sourced Funding Equity Raising so that professional advice can be given to clients.

- Traditionally small “mum and dad investors” were unable to access investments in new emerging companies unless they were able to buy shares on the Stock Exchange for the company in which they were interested in investing. This meant that they were not able to take advantage of many investment opportunities which were financed through the venture capital market/wholesale markets. Investors of all sizes can now participate in this new market.

- One of the Intermediaries is specialising in the agricultural/energy industries and there is an expectation that some other Intermediaries will also elect to specialise in particular industries.

If, after having read these comments from representatives of the Intermediary companies, you're interested in having further discussions with us relative to the possibility of your company exploring the potential to utilise this new business financing phenomenon – arguably the biggest business financing change for small businesses and medium sized enterprises in the last 35 years, please do not hesitate to contact the accountancy person in our firm with whom you normally deal.

HAZARD OR RISK? DO YOU KNOW THE DIFFERENCE?

By Jordan Lowry, Managing Director, Blackstone Business Group –

To understand how to manage risk we must first understand the difference between a “hazard” and a “risk”.

So, what is the difference between a “hazard” and a “risk”?

A “hazard” can be identified as anything that has the potential to cause harm.

A “risk” is the potential that a hazard will cause harm.

When it comes to health a “hazard” is the possibility of something causing harm whilst “risk” is the likelihood or probability of something causing harm.

Take for example a ladder; the ladder is a “hazard” and someone climbing the ladder and falling off is a “risk”.

With a ladder there is always the possibility of someone misusing the ladder, but, until they misuse the ladder, the ladder remains a hazard. Therefore, when someone misuses the ladder, the hazard converts to a risk of falling or injury.

Another example is a venomous snake. The snake is a hazard, getting bitten by the snake is a risk.

Now that we have an understanding of the difference between a hazard and a risk, how then do we determine the specific risk that a hazard poses?

First, we assess how likely it is that someone will be exposed to a hazard.

The likelihood will then depend upon the probability and frequency of exposure to the hazard. We also assess the most likely outcome. The outcome is the severity or range of the potential consequences resulting from the hazard.

Remember our aforementioned venomous snake? The hazard, in this case, is our venomous snake. In this instance, however, the snake is contained in a secure glass snake enclosure. Rating the hazard, our snake, against the severity and probability scale, we would most likely say that the risk to a person in the room is minor and remote.

Change the circumstances and take the snake out of its enclosure and we change the rating to probable and severe.

This is how we must assess hazards and risk within our workplace. The same hazard in two workplaces can have vastly different outcomes based on how we manage and control the risk associated with that hazard.

There are tools in place to manage risk and control hazards such as the hierarchy of controls.

Another tool that employers must implement are risk assessments and JSEA’s. These are vital in mitigating risk and protecting your workforce.

If you have concerns about safety in your workforce or would like training in how to understand the hierarchy of control, we are available to answer any questions via .

WHAT'S IT MEAN?

"Retail Investor"

The terminology “retail investor” is being used on a wider basis since Crowd Sourced Funding Equity Raising commenced.

The following is the definition of a retail investor:

The person to whom the crowdfunding service is provided will be “a retail client” unless one or more of the following tests are satisfied:

- The product value test:

The price of the financial product (the securities on offer) or the value of the financial products to which the financial service relates, equals or exceeds $500,000.

- The securities or crowdfunding services provided for use in a business other than a small business: For these purposes a small business is defined as a business employing less than 20 people, unless the business includes the manufacture of goods, where the business must employ less than 100 people.

- Where securities or the crowdfunding services is not provided for use in connection with the business, the person acquiring the securities or crowdfunding service gives the Intermediary a certificate prepared by a qualified accountant within the preceding 2 years that states that the person has net assets of $2.5 million or gross income in the last 2 financial years of at least $250,000.

- The person to whom the crowdfunding service is provided is a professional investor. A professional investor includes an Australian Financial Services licensee, a listed entity, a bank, or a person who has or controls gross assets of, at least, $10 million.

"Sophisticated Investor"

A "sophisticated investor" is defined as follows:

An offer of a body’s securities does not need disclosure to investors if:

- the minimum amount payable for the securities on acceptance of the offer by the person to whom the offer is made is at least $500,000; or

- the amount payable for the securities on acceptance by the person to whom the offer is made and the amounts previously paid by that person for the body securities of the same class that are held by the person add up to at least $500,000; or

- it appears from a certificate given by a qualified accountant no more than 6 months before the offer is made that the person to whom the offer is made:

- has net assets of at least $2.5 million; or

- has a gross income for each of the last 2 financial years of at least $250,000 a year.

CREATION OF A SPECIAL DIVISION FOR SMALL BUSINESS TAXATION DISPUTES WELCOME NEWS

It is pleasing to see that the Australian government has made changes to the approach to small business taxation disputes with the Australian Taxation Office.

The way the Australian taxation system works regarding disputes with the Australian Taxation Office (ATO) has been on a pay now fight later basis and even if there is current legal litigation occurring with the ATO, the Taxation Office’s position was that the debts still have to be paid even though the dispute is ongoing.

This situation, of having to pay the ATO and then having to fund a legal battle against the ATO is never pleasant and the payment to the ATO and funding of the legal and accounting expenses can prevent a taxpayer from being able to adequately mount a defence and continue trading in business.

A recent initiative of the Australian government was the creation of a special division within the Administrative Appeals Tribunal (AAT) that deals specifically with small business taxation matters known as the “Small Business Taxation Division”. The major benefit to small business operators of this initiative is that only taxation matters will be dealt with in the special division of the AAT.

It is also welcome news that the Australian Small Business and Family Enterprise Ombudsman’s office will provide the unrepresented small business taxpayer with some free and discounted legal advice and a dedicated case manager throughout the process with the Administrative Appeals Tribunal.

A dispute resolution instruction bulletin has been issued by the ATO which summarises the ATO policy and principles on conducting litigation in the Small Business Taxation Division of the AAT. The key commentary in this bulletin is that the ATO “will not enforce recovery of the tax debt in dispute before the Small Business Taxation Division – other than in exceptional circumstances”.

Many small businesses, subject to an adverse finding from the ATO, do not have the funds to pay the alleged debt and pay for accounting and legal advice to fight the finding by the ATO which is why this change, implemented by the Australian government, will make a difference to small business operators who have a disagreement with the ATO, as long as the taxpayer has an aggregated turnover of less than $10 million per annum.

At a recent convention of the Taxation Institute of Australia, the Commissioner for Taxation in a speech mentioned that “small business taxpayers had the highest percentage “tax gap” across all the ATO taxpayers' segments.”

The tax gap is the ATO’s attempt to calculate the difference between the “theoretical level of tax paid” and the “actual level of tax paid”.

In his speech the Commissioner of Taxation identified that the ATO is of the belief that small business taxpayers are paying less income tax than they should.

The consequences of this statement will probably mean that the level of tax audits for small business taxpayers is likely to increase and the number of disputes with the ATO in the future is likely to increase.

Small business taxpayers, caught up in these types of disputes, will have reason to be appreciative that the government has created the special division within the AAT to decide on small business taxation disputes.

If you have any questions concerning the policies of the ATO relative to disputes on taxation matters, please do not hesitate to contact us.