Issue 95 – March 2019

Single Touch Payroll Now Applies To All Businesses

The legislation extending Single Touch Payroll to all businesses with less than 20 employees was passed by the Australian Parliament last week.

The Australian Taxation Office has indicated that each of the 16 companies which have indicated they are developing suitable products have stated that their products will be priced at less than $10 per month.

The Taxation Commissioner has acknowledged that there is a very short period of implementation available before 1 July 2019 and, for this reason, he has announced a three month buffer, with businesses allowed to start reporting any time between 1 July 2019 and 30 September 2019.

If you would like to discuss with us the options that are available for you relative to the selection of a suitable Single Touch Payroll system, please do not hesitate to contact us.

Growing Your Business In 2019

(cont'd from last month)

- Periodic reviews of expenses in each of the business’ activities to ensure that “value for money” is being achieved from each purchase transaction.

- Preparation of a business plan which incorporates all aspects of the business and clearly identifies the strategy that the company wishes to implement.

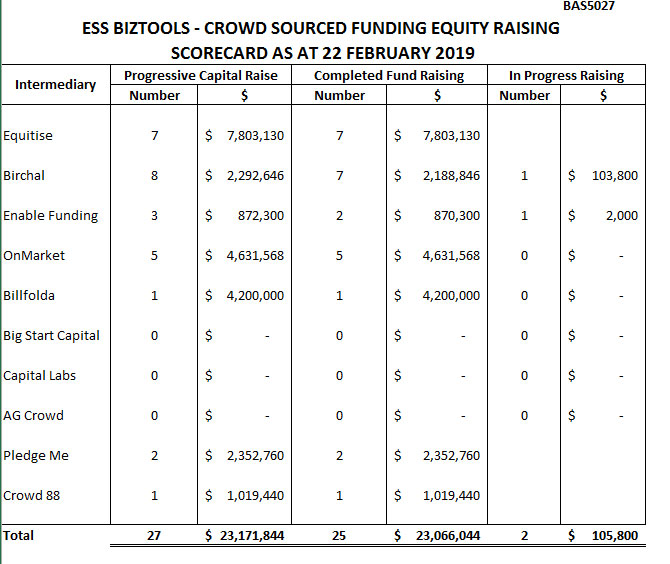

CROWD SOURCED FUNDING EQUITY RAISING SCORECARD

$23.1 million has been raised by 27 companies by utilising Crowd Sourced Funding Equity Raising as at 22 February 2019.

A summary of the Crowd Sourced Funding Equity Raising Scorecard indicating the results of equity capital raised on behalf of companies by the individual Intermediaries is as follows:

Key Factors For A Successful Business

A client asked us recently “what are the key factors for a successful business”? We think the following are some of the important factors to take into consideration:

- Think about “scaling up” your business from the very beginning of the business, no matter how small the business. This means implementing systems, regular meetings, adopting business strategies, thinking about the future, thinking about your exit strategy.

- Appoint a mentor – someone who understands business who you can talk to.

- Appoint a board of advice and then, as you grow, a board of directors.

- Determine a meeting schedule relating to your team, advisors and board of directors or board of advice members.

- Your team – you will need a schedule relating to daily, weekly, monthly meetings.

- Establish a system that will determine a weekly profit/loss estimate for your business.

- Undertake a risk management review and establish risk management procedures relating to:

- insurance policies

- Personal Property Securities Register Registrations

- protection of intellectual property owned by the business

- Know your customers – their demographics, preferences.

- Allocate key responsibilities to your team members or external advisors so that you have an “executive team” you can discuss issues with daily/weekly including:

- operations

- purchasing

- marketing

- selling

- chief financial officer/company secretary

- legal

- Establish a debtors' system that facilitates the prompt preparation of tax invoices, debtors' statements and registrations on the Personal Property Securities Register (if necessary).

- Establish a system for the recording of the business’ investment in inventory and the determination of inventory management information.

- Establish a system for the recording of work in progress, in particular the identification of any jobs that are not being invoiced regularly.

- Establish a monthly reporting process to include:

- detailed financial accounts prepared on an individual operation basis

- operational reports prepared by the manager or person in charge of each operational unit

- comparisons to budget

- strategies for the next month

- A schedule of management team meetings to be held on, at least, a monthly basis.

- A schedule of board of directors or board of advice meetings to be held monthly or on some other basis that ensures that there are at least 6 meetings per annum.

Please do not hesitate to contact any of the team in our firm for a discussion on the development of strategies for the operations of a successful business.

GRANTS AND ASSISTANCE UPDATE

- Natural Disaster Grants

The Australian government has made some changes to the quantum of grants available and the conditions relating to those grants following the recent floods in Townsville and Northwest Queensland.

There has also been significant loss of property from bushfires and other natural disasters in Victoria, Tasmania, South Australia, Western Australia, Queensland and New South Wales over the last few months.

Australian government grants and other assistance is available for farmers and small business operators if you have been affected by a natural disaster. If you require assistance relating to the preparation of a disaster grant application for submission to the government, please do not hesitate to contact us.

- Accelerating Commercialisation Grant

The Accelerating Commercialisation Grant is part of the Entrepreneurs' Program delivered by the Australian government. If you have developed a new product process or service and have now realised that it is going to cost a lot of money – possibly more than what you have at your disposal – to get your invention into the market.

This is what the Accelerating Commercialisation Grant was developed for. It costs a lot of money to successfully commercialise a new product, process or service. The grant is available in various amounts up to a maximum of $1 million and is supplied on a 50% basis.

- Early Stage Innovation Company

We know that finding your 50% can be a challenge and would be happy to talk to you about this. The Australian government realised the difficulties that many people have in raising their share of the funding and for this reason created the Early Stage Innovation Company Capital Raising Process which incorporates some attractive benefits for investors. In this way the government is happy that investors will look more favourably at a company which has developed new technology if there are some inducements offered by the government.

The inducements that are available to the investors include:

- 20% tax offset based on the amount of the investment made by the investor, up to a maximum of $10,000 tax offset for a retail investor (the maximum investment per company is limited to $50,000) and for a sophisticated investor the maximum tax offset is $200,000 calculated at 20% of the investment to a maximum investment of $1 million (but the actual investment for a sophisticated investor can be higher).

- Investors can also be eligible to benefit from a capital gains tax exemption on their investment in an Early Stage Innovation Company, if they hold their shares for longer than 12 months and less than 10 years.

If you would like to have discussions with us relating to the Accelerating Commercialisation Grant and Early Stage Innovation Company Capital Raising, please do not hesitate to contact us.

A HR LESSON FROM THE AIR FORCE

By Jordan Lowry, Managing Director, Blackstone Business Group

Over a number of years and hundreds of interactions with Australian employers, it has become ever apparent to me that the majority of employers in Australia are "reactive" rather than "proactive." It is quite a common practice for employers and managers to mentally take note of an employee's mistakes and performance issues but, instead of saying anything to the employee in question, they keep it to themselves.

Eventually, the employer reaches their boiling point and wants to take immediate action against the employee. It is usually at this point that the employer approaches their HR manager or their HR provider to make this happen. Unfortunately, this is where we have to let the employer know that without a body of evidence and an established due process, the required disciplinary process can be rather drawn out and is far from something that can be actioned "straight away".

So, what can be done as an employer to ensure you are always ahead of these issues?

There is a great example that I share with employers that I learned whilst doing leadership training with the Australian Defence Force.

When setting up for an operation, the Air Force follow the principals of the acronym P.B.E.D.

P.B.E.D. stands for Plan, Brief, Execute and Debrief.

At the "Planning" stage they make sure that they have the right personnel and assets allocated to the mission. For example, if a mission requires four F18 Hornet jets to complete the mission, they will already have a plan in place to complete the original mission with three jets so that, in the event that something unplanned happens such as the loss of a jet, the mission can still go ahead without having to go back to the base and re-plan the mission. The same is true when it comes to our business plan or strategy. Make sure that you have the right assets and personnel allocated to your vision and strategy.

Remember to also always allow for contingencies. Prepare for the unexpected.

Following the "Planning" stage the Air Force then enters the "Brief" stage. It is at this stage that everyone is briefed on the role that they will play and the purpose that they will serve in the coming days or months. It is imperative that each person truly understands their role in the success of the mission. Each person plays a key part in the operation.

It is also very important to not only brief team members on their role but to make sure that they understand what their mission is. For example, prior to the operation, all involved are quizzed by various parties about the role that they will be playing to make sure that they understand what is expected of them.

The same is true in the workplace. We must make sure that all team members truly understand the role that they play in the success of the business. Highlight the value that they bring but also stress the importance of each team member achieving the targets and KPIs set out for them.

The "Execution" step is quite straight forward. This is when we put into practice everything from the "Planning" and "Briefing" stages. Regular communication is integral to keeping the execution of the mission on track.

Following the "Execution" stage, we enter the "Debrief" stage. Now, this is the stage that relates to the overall theme of this article. The "Debrief" stage is what allows us to be "Proactive" rather than "Reactive". Following a mission, the Air Force gathers all personnel involved in the mission together for a debrief to look back on the mission and to identify what worked, what didn't go to plan and how they can improve this on the next mission.

Whether an employer, director or manager, ask yourself, when was the last time that you debriefed your staff? When was the last time you sat down and went over the results of the last quarter?

Implementing a debrief, appraisal or check-in process on a regular basis (I recommend each quarter) is a valuable tool in any business. It allows you the opportunity to have a regular touch point with your employees. This neutral platform allows both parties to provide feedback on what is working, what isn’t and then allows you to establish a plan moving forward. It also allows you the opportunity to address performance issues and offer support and assistance to the employee. Unfortunately, some employees may not reach the standards that are required of them however, unlike the situation at the outset of this article in the event that there is a pattern of underperformance, thanks to the appraisal process, you will have a strong body of evidence to support your performance management process.

If you would like any further information on performance management, the appraisal process or would like to speak with a Blackstone consultant about our complimentary appraisal forms, we are contactable at or on 0418 287 730.

DO YOUR CUSTOMERS RECOMMEND YOUR BUSINESS?

- Do your customers say “WOW”?

- Do they recommend your business to their friends and associates?

- Do you acknowledge long-term clients for their continuous support of your business?

- Do you send letters/emails to new customers thanking them for their patronage?

- Do you encourage customers to give you referrals to their friends and associates?

- Do you ask clients for testimonials which you can post onto your website?

- Do you give guarantees? Do your team members understand how to process guarantees?

- Have you discussed with your team members the “lifetime value of a customer”?

- Are your team members familiar with the strategies that you have implemented relative to the processes of scaling up a “customer” to a “client” and then to an “advocate”?

- Do you utilise a customer relationship management system (CRM)?

- Do you understand the demographics of your customers?

- Do you have procedures in place for handling customer’s complaints?

- Do you offer events or ongoing training/familiarisation to your clients?

- Have you developed information videos and webinars that are available from a secure section of your website for your customers to access?

- Do you prepare a regular newsletter/video alerting your customers to recent developments within your business and your industry?

If you would like to have a discussion with us relative to reviewing the services that you are offering your customers please do not hesitate to contact us.

TAXATION BASICS

The reason why people become great, is that they consistently practice the basics of any sport, skill or application of knowledge. This is why some people are called the GOAT (Greatest of All Time) and because they do the basics so well and so consistently they get better at those skills which then improves their ability to solve more complicated problems which rely on their sound knowledge of the basic skills.

In the last year there has been more cases that should never have reached the Australian Administration Tribunal (AAT) or the Federal Court and it is because either the client or their advisors have not looked at the basic elements of the arguments.

Any time there is a GST matter, you need to go through the basic conditions for GST, such as, the elements. Do you need to be registered for GST? Are you conducting an enterprise?

Simple matters for income taxation are: care needs to be given to the contract to ensure that a GST event is occurring, such as are you selling a capital asset and not an asset subject to Division 40 and excluded from the capital gains tax system?

As professional advisers we are the experts relative to the application of taxation knowledge and we can apply our knowledge quickly to identify any problems that have arisen and how to solve them.

Whilst slowing down and working through these matters making sure each element is dealt with before moving onto the final problem, will not make much of a difference in the long run, but a big difference between winning and losing an argument you have with the Australian Taxation Office, if you ever end up in a disagreement or in a court case with the Australian Taxation Office.

If you have any concerns about any matter relating to your taxation affairs, please do not hesitate to contact us for a discussion.

THINKING ABOUT BEING A BUSINESS PERSON?

Your chances of success will be considerably enhanced:

- If you know something about the industry.

- If you don’t know something about the industry you undertake some studies/attend a course/or get some paid or unpaid employment in this industry.

- If you have undertaken some research as to where you will obtain supplies for your business and preferably you would have made some contact with the suppliers to get an indication as to what products they will be able to supply and on what terms and conditions.

- If you have made enquiries as to whether you require a license or a special qualification to be able to operate in this industry.

- Business people should be conscious of envisaging “scaling up” of the business from the very beginning, no matter how small:

- “Start up” with 1 to 5 team members.

- “Grow up” with 6 to 15 team members – would now be an established business – key requirement building a good team.

- “Scale up” with 16 to 250 members – the business will definitely need “scalable systems” so that the business could operate without the day-to-day involvement of the owner/CEO. The biggest challenge will be keeping your team aligned and growing.

We wish you well if you have decided that you want to be a business person. Please make an appointment to have a discussion with us relative to the range of commercial orientated services that we can deliver to assist you on your business journey.