Issue 102 – August 2019

44 COMPANIES HAVE RAISED $37.2 MILLION!

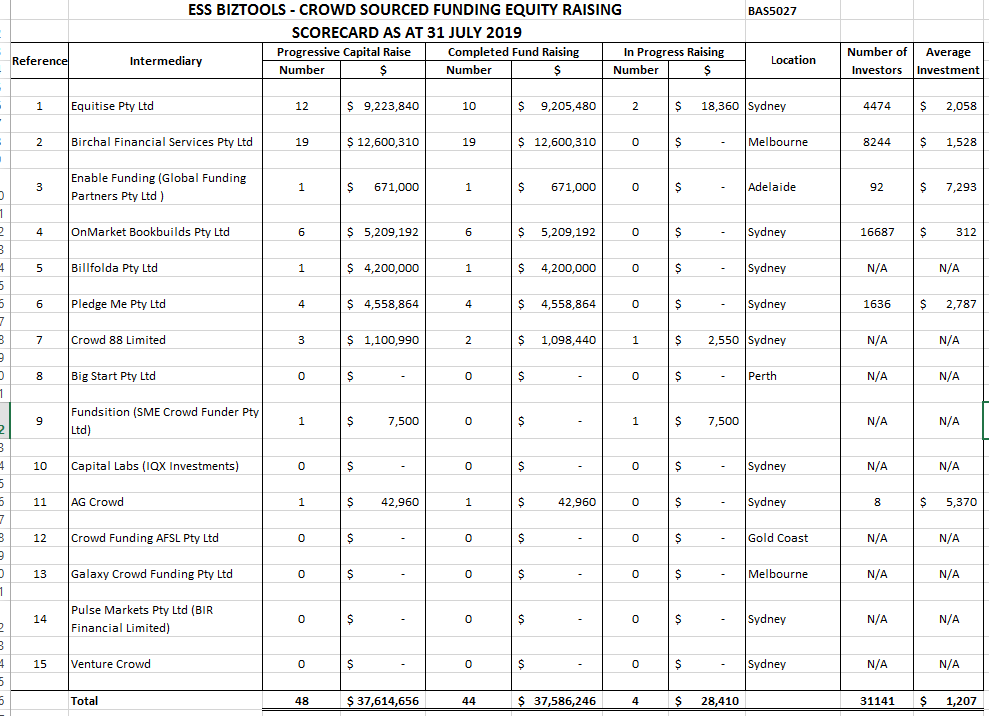

Nine of the Crowd Sourced Funding Intermediaries appointed by the Australian Security Investment Commission (ASIC) have guided companies through the capital raising process thus enabling 44 companies to have raised a total of $37.2 million from 31,138 individual investors from Crowd Sourced Funding Equity Raising as at 31 July 2019.

The recent capital raisings include companies operating in a variety of businesses:

- Relationship lending platform

- Dedicated champagne business

- Solar energy company (the second capital raise by DC Power Co)

- Organic Aussie health brand

- Independent financial advice business

- Sport and fitness equipment

- Echo-innovative outdoor gear

- App for hospitality workforce

- Artificial intelligence to provide diagnostics for agricultural pests and diseases

Crowd Sourced Funding Equity Raising is specifically designed for companies with annual turnovers under $25 million. If you would like to have a better understanding of how Crowd Sourced Funding Equity Raising operates please do not hesitate to contact us.

A summary of the Crowd Sourced Funding Equity Raising Scorecard produced by ESS BIZTOOLS as at 31 July 2019 is as follows:

SOCIAL MEDIA – TOOLS THAT MOST BUSINESSES WILL FIND USEFUL!

Social media opens the windows and doors into your business and allows you to tell your story about your business, your team, yourself.

One of the key questions is “What do your customers and prospects really want from you?” You then have to decide how you can deliver answers to those questions that will satisfy your clients and prospects.

The key challenge for businesses is to create content that “evokes an emotive response.”

You need to remember that social media conversations are happening on a public stage therefore they are viewable by the whole world.

To successfully utilise social media platforms the messages that you are conveying on social media need to be integrated into all aspects of your business operations for your business to be successful.

One of the first questions that business people must answer is: “Who is your ideal customer – your Avatar?” (An Avatar is the characterization or persona of your ideal customer)

The various social media platforms target to different numbers of people and different demographics. The reported numbers of participants on the various social media pages in Australia are:

- Facebook – 10 million users of which 9 million are using mobile devices to access

- Linked In – 4 million users – 57% male

- Twitter – 2.9 million users – fastest growing user group aged 55 to 64

- Instagram – 9 million users – 60% aged under 30 and 68% of users are female

There are businesses offering social media support in most parts of Australia.

REGULAR MEETINGS CONTRIBUTE TO BUSINESS SUCCESS

The concept of “working on your business” rather than always “working in your business” illustrates the desirability for directors and managers to have some “time out” from day to day activities periodically. One of the key activities that could be conducted at least four times per annum is to have a meeting with your accountant to consider your overall business performance.

As businesses grow most businesses find it desirable to appoint an accountant as their Chief Financial Officer. This appointment acknowledges that there are many aspects of the business operations that require a financial input on a daily basis.

We acknowledge that this same requirement for financial advice beyond the preparation of annual accounts and income tax returns applies also to small businesses and medium sized enterprises who in the main will not have a full-time accountant working for them who can perform the Chief Financial Officer role similar to what happens in larger companies.

A regular meeting enables the Owner/CEO/General Manager of your business to meet with the partner, manager, accountant from our firm that you normally deal with to give you the opportunity to discuss with us a range of financing issues that are of concern to you in the operation of your business.

Our suggestion is that we establish a standard Agenda for these meetings, but other items can be added as required during the year and yes, if you wish, to discuss taxation issues we will be happy to give you our input on your business’ taxation affairs but we do not envisage that taxation is the primary reason for this series of meetings.

We acknowledge that the preparation of an Income Tax Return does not “add value” to your business. It is the “add value” areas that we recommend should be treated as high priority items in this regular series of meetings.

Our suggestion is that we meet with you and any members of your management team that you care to invite on at least a quarterly basis (but the schedule could be on a monthly basis) and that we both agree on the dates of these meetings twelve months in advance so that they are locked into our calendars.

Obviously, these meetings are for your benefit and therefore we acknowledge that the Agenda for these meetings should be approved by you and that the necessary reports for discussion at the meeting are prepared in sufficient time to be distributed to you, if we are preparing them, and to us if your team is preparing them, so that we are both prepared for discussions at the meeting.

We acknowledge that business is getting more competitive by the day and that there is probably many issues that we could make suggestions on relative to activities within your business that will add value – our overall objective is to help you run a better business.

Some of the items that we thought you might like our input on in these meetings includes:

- Are you happy with the format of the Financial Reports that are prepared during the year?

- Do these Financial Reports give you meaningful information on how the various sections of your business are operating?

- Analysis of financial performance for the previous. – Quarterly or monthly

- Key Performance Indicators

- Comparison to Budgets

- Cash flow position as compared to Budget

- Comparison to industry benchmarks

- Analysis of revenue and gross margins

- Where did the money go? – We will prepare a straightforward Source and Application of Funds Report which identifies the cash that was generated within the business and where it was spent for the period under review.

- Customer analysis

- It is very important to analyse who your new customers are but also to review any lost customers and try to determine reasons why those businesses/consumers have gone to someone else.

- Average sale for the quarter preferably on a departmentalised basis and comparison to the previous period and the Budget.

- Gross profit percentage calculated for individual departments and product lines if that information is available from your computer system.

- Prospect Analysis

- Review of the prospects that have been identified within your CRM (Customer Relationship Management) system

- Sales made to prospects.

- Conversion percentage of prospects to customers/clients.

- Sundry Debtors

- An analysis of the debtors position including

- Debtors’ days outstanding

- Debtors’ aged analysis

- Bad debts written off since the previous meeting

- Problem debtors

- Discussion on changes that could be made within your systems in an attempt to eliminate problems with debtors.

- Inventory (stock)

- Value of the investment as compared to the Budget estimate

- Stock turn rate – preferably on an individual stock basis but if this information is not available, on a departmentalised basis.

- Discussion with you relative to the current investment in stock and what that investment is projected to move to over the next six months.

- Discussion with you relative to the cash flow effects of the build-up of stock at particular times in the year e.g. Christmas – is it possible to negotiate longer payment terms with suppliers to reduce the cash flow pressure from this stock build-up?

- Work In Progress

- What is the investment in work in progress?

- How does this compare to the budget?

- Analysis of jobs remaining in the work in progress category for more than 30 days. Is there a problem within a particular job that is causing a delay in the finalisation of that job?

- Sundry Creditors

- Discussion on the amount owing and in particular on the creditors aged analysis and creditors days outstanding

- Are there any creditors who are being paid on terms longer than have been negotiated with them?

- Team

- What has happened within the team since the previous meeting relative to:

- new engagements

- resignations

- retrenchments

- dismissals

- What was the sales income per individual team member in this period as compared to other periods.

- Cost Control

We acknowledge that cost control is a very important item for businesses. We propose that at the meetings we will be able to discuss strategies that might be able to be implemented that can assist in the control of costs within your business. - Business Financing

There are a lot of changes currently occurring in business financing for small and medium sized enterprises. Our suggestion is that at each of these meetings we have a regular agenda item that will encourage us to examine:

- Bank support

- other finance company support

- debtors’ financing

- supply financing

for your business and discuss the development of new strategies. - Capital Raising

There are now opportunities for small businesses and medium sized enterprises to be able to raise capital from the public rather than borrowing money from banks and other financial institutions thus requiring an asset to be offered as security for that borrowing, personal guarantees to be given by owners/directors and monthly principal and interest repayments to be entered into.

The capital raising opportunities that are available include:- raising capital under section 708 of the Corporations Act (a propriety limited company can raise up to $2 million from a maximum of twenty investors in a twelve month period);

- companies which are under three years of age who have developed a new product process or service could give consideration to becoming classified as an Early Stage Innovation Company so as to take advantage of this registration which could prove attractive to potential investors who are able to qualify for a tax rebate based on their investment in the company and potentially to a capital gains tax exemption on that investment.

- Crowd Sourced Funding Equity Raising – is now available to propriety limited companies and unlisted public companies that have turnovers under $25 million – these companies have the potential to be able to raise up to $5 million in share capital direct from the public in a twelve month period.

- Initial Public Offering (IPO) if your ambition is to be listed on a stock exchange than at this series of meetings we could discuss the strategies for getting the company “investment ready” so that an IPO could be instigated.

- Grants

Our suggestion is that a regular agenda item for these meetings should relate to “grants”. There are hundreds of Federal, State and Territory grants operating in Australia. We will be able to give you an update at the meeting on grants that are available that are targeted at businesses similar to yours so that a decision could be made as to whether a grant application should be submitted. - Risk Management

At each meeting we suggest that there is a discussion on risks that are currently affecting the business or could affect the business so that strategies could be developed to offset the problems that a particular risk could present to the ongoing business operations.

We would suggest that the Personal Property Securities Register be considered as part of the risk review. - Pricing of Products/Services

We believe it would be beneficial as part of the concept of adding value to your business for a review on the performance of the various activities within the business relative to achieving the profitability target that has been set in the Annual Budget.

This would probably require a review based on current labour costs and productivity, direct material purchases mark-up percentage, targeted profitability, to determine charge out rates based on these revised inputs as compared to current charge out rates been utilised, to facilitate a discussion as to whether charge out rates or pricing should be changed. - Research, Development and Innovation

At each meeting it would be desirable that reports on any research activities are submitted. - What if?

We are well aware that there are many issues that arise in a business on a daily basis that pose a “what if” question. In larger organisations the Chief financial Officer is an intricate member of the group that is considering “what if” questions in many cases on a daily basis.

We believe that these regular meetings will be a good forum to discuss questions relative to the operation of your business. Obviously, if the “what if” question requires an urgent response we are most happy for you to contact us direct at that time to raise the question with us. - Valuation of your Business

We will always be conscious of the ultimate saleability of your business by making suggestions that will contribute to a better bottom-line performance and system enhancement that should justify the use of a higher multiplier in the valuation of your business.

Our proposal is that we will prepare a valuation of your business based on generally accepted business principles for the valuation of similar businesses to yours at least once per annum so that you can monitor the changes in the valuation of your business. - Succession Planning

Part of the strategy for creating a higher valued business is the implementation of a training/professional development strategy in conjunction with succession planning at every level of the business so as to ensure that your business has a well-trained, informed, enthusiastic team. Our suggestion is that the succession planning strategy is discussed at each meeting - Superannuation/Retirement Planning

Our proposal is that at each meeting there would be a discussion on the level of superannuation contributions that you are making together with a general review of your retirement aspirations and how you are planning to fund your retirement. - Business Readiness

An important component of the meeting process will be to review at each meeting the ongoing development of the company/business so that the business is alert to opportunities within the marketplace to consider a potential trade sale, acquisition of another business, expansion of the business into other areas, undertaking an IPO etc. - Systems review

At each meeting we will discuss with you any suggestions which you have or which we are proposing relative to system changes within your business. - Key Strategies for the Next Quarter

One of the key reasons for suggesting an ongoing series of quarterly meetings is to assist in the identification of a number of key objectives to be implemented by the business in the following quarter. Our suggestion is that following the discussions on all the foregoing issues that you then agree on the identification of key strategies for the leadership team and all other team members to assist in the implementation of these key strategies over the next three months. - Corporate Governance

To gain the maximum value from each of these meetings we suggest that the Agenda and supporting reports are distributed at least three days prior to the meeting so as to enable each participant to have read the material prior to the meeting.

At the conclusion of the meeting we will be able to assist in the preparation of Minutes of the matters discussed and the preparation of individual action plans to be distributed to persons who are responsible for implementing action that has been decided on at the meeting. - Want more information?

If you would like to have a discussion with us relative to the concept of establishing a regular meeting arrangement with your business please do not hesitate to contact the person in our firm that you normally communicate with.